by Richard Cull

November 2021 Market Recap & Commentary

Commentary

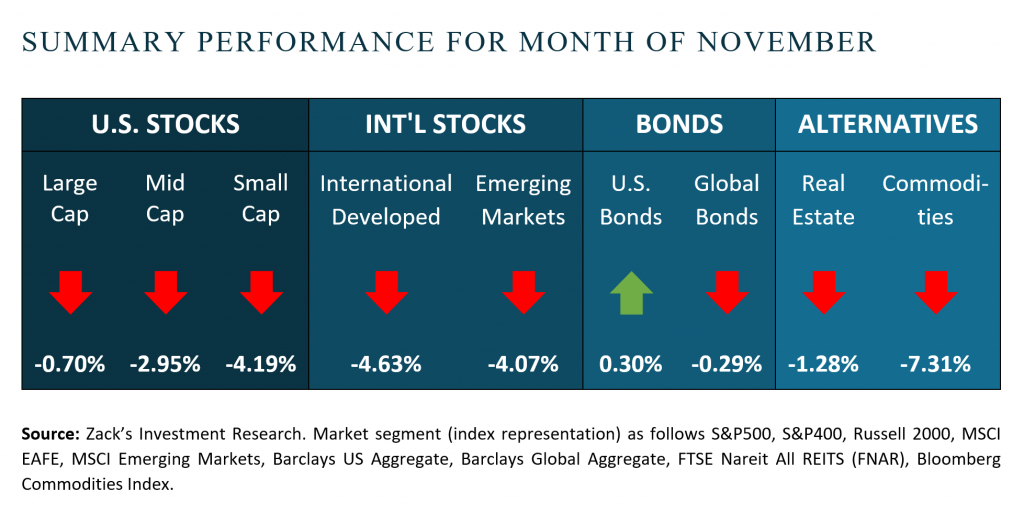

The month of November was like the tale of two markets...the first 18 trading days saw positive returns for the majority of asset classes, while the last three saw a volatile tug-of-war that left negative returns virtually across the board.

Two of our most important fundamentals continued to be impressive over the last 30 days. Corporate earnings for the third quarter showed a large increase (+ 42%) over the same time period a year ago with 80% of the companies beating EPS estimates. The fourth quarter is expecting more growth, all be it at a less eye-popping rate of + 19% year over year. These numbers would be even higher if not for the worker shortage and supply chain bottlenecks.

Consumer spending also remained robust as evidenced by Black Friday sales that rose 47% for in-store purchases and were basically flat against last year’s record on-line sales. Americans are also spending more per transaction according to Shopify, with this year’s average hitting $101.20 versus $90.70 last year. Inflation is apparent to consumers, but it has not slowed their spending…yet.

All of this news was overshadowed however, by the news of a new variant of COVID-19 labeled “Omicron”. In the holiday shortened trading day last Friday the markets fell 2% - 3% as traders instantly brought out the old pandemic playbook... Sell travel / energy / hospitality / etc.... Buy stay-at-home plays / vaccine makers / etc. Over the holiday weekend, emotions calmed, fear ebbed, and investors sent the markets up swiftly on Cyber Monday. But the last day of the month, the fear-euphoria-fear pendulum swung back and resulted in heavy selling of stocks, Gold, Bitcoin and Commodities (the near-term Crude futures contract settled 20% below its October close).

As we believe investing is LONG-TERM, we normally do not highlight the day-to-day movements in the markets. But this is an opportunity, in real-time, to observe market performance when solid fundamentals are interrupted by (hopefully) SHORT-TERM uncertainty.

The last month of the year should be anything but dull.

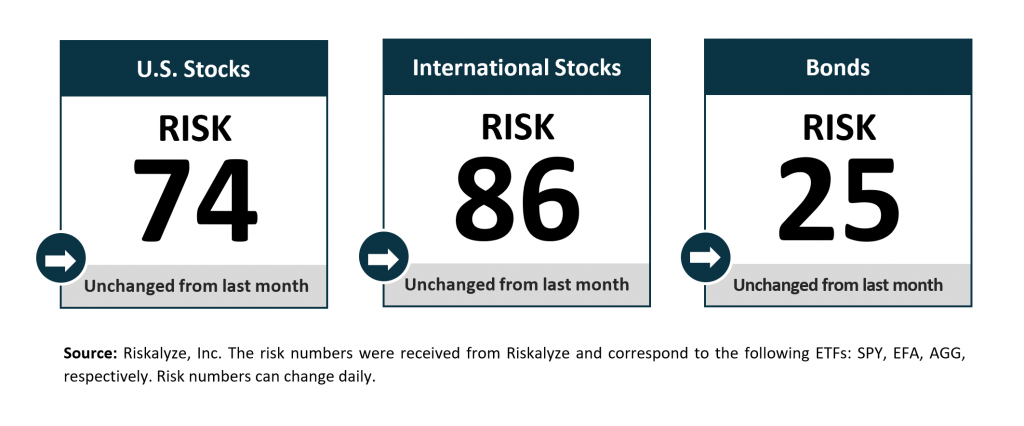

Risk Numbers

The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them. The following graphic shows the risk of various asset classes as measured on a scale of 1-99 (1 being the most conservative and 99 being the most aggressive) as of the date above.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?