by Richard Cull

May 2022 Market Recap & Commentary

Commentary

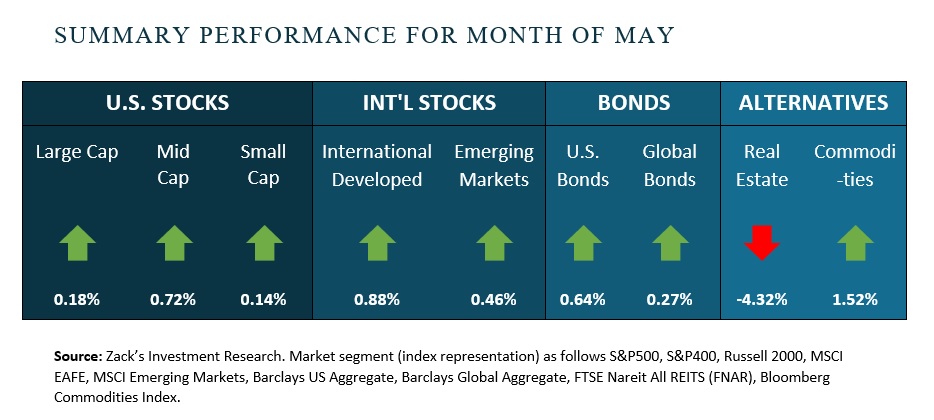

The month of May was yet another challenging for the financial markets. The final numbers for the month were slightly positive but before last week it seemed like the markets couldn't register even a weekly gain.

To wit, the Dow Jones Industrial Average (DJIA) registered eight straight weekly declines, the longest such streak since 1932. Against that backdrop of doom & gloom, the equity markets promptly shot up an impressive + 6% in just five market days. It was the latest reminder that ”time in the market” is far better they trying to ”time the market.”

The financial news during the month was again dominated by the “Big Three” which are rising inflation, a tightening Federal Reserve and the war in Ukraine. Investors were provided with some insight on the effect of these issues as companies released first quarter earnings. Overall, the numbers were solid with earnings up + 9.6% and Revenues up + 13.5% over the first quarter of 2021. However, some companies posted decent numbers but tempered expectations going forward citing issues including the challenging pricing environment, higher input and labor costs, and latest China shutdown. In more than a few instances, these “warnings” led to severe selloffs (Target, Royal Caribbean, SNAP). It is becoming evident that some areas of the economy are thriving with strong consumer demand and the benefits of pricing power, while other sectors are still trying to make adjustments to higher costs and shifting consumer behavior.

Something that may have grabbed your attention is the fact that the S&P 500 entered Bear Market territory (a decline of more than 20%) during the May 20th trading session. Combined with the elevated volatility since the first of the year and some investors are now considering exiting the markets. While understandably stressful, we want to reiterate our belief in INVESTING, not TRADING. To add more color to this concept of not moving to the sidelines during Bear markets / market corrections, we offer a few statistics from Zacks Investment Management, The Wall Street Journal and Charles Schwab.

First, it is important to note that since 2002, over 85% of the best days in the market occurred after the worst days, which underscores the importance of not making any sudden moves in response to a big down day.

The second point is to remember what could happen if anyone tries to time the market and ends up missing some of the best days. Over the 20-year period from January 1, 2002, to December 31, 2021, the S&P 500 index delivered a stout annualized return of 9.52%. However, if an investor missed just the best 10 performance days – which again, often happens in close proximity to the bad days – the annualized return would be cut nearly in half, to 5.33%.

And finally, no one can know when the market correction will run its course. Corrections can last weeks or months, with rallies giving way to sell-offs and the market often looks like it has no clear direction. But one thing we do know is that equity investors with goals of growth do not want to be on the sidelines when the correction does indeed end. Since 1974, the S&P 500 has jumped an average of +8% one month after a correction bottom, and more than +24% a year after a correction bottom.

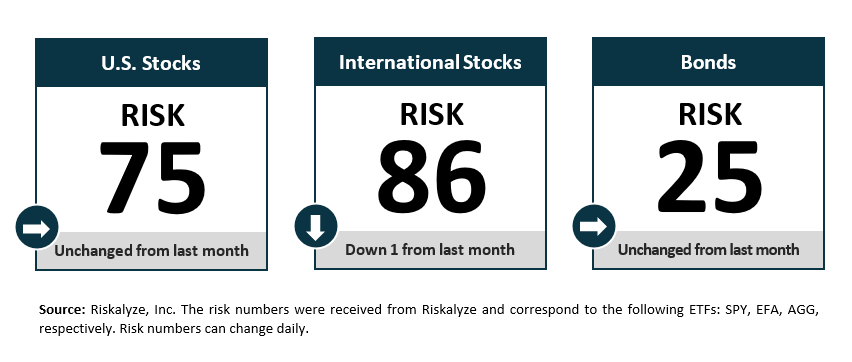

Risk Numbers

The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them. The following graphic shows the risk of various asset classes as measured on a scale of 1-99 (1 being the most conservative and 99 being the most aggressive) as of the date above.

Centric's Approach

We start with a Risk Number, a measurable way to pinpoint how much risk you want, need, and already have. Then, your wealth advisor will optimally allocate our investments to help you reach your financial goals. Along the way, you will receive transparency of information, seamless proactive service and the trust and accountability you need to stay on track. All of this will lead to your personal comprehensive investment strategy that is powerful, disciplined, responsive.

Sources:

Centric’s Market Assumption Disclosures: This information is not intended as a recommendation to invest in any particular asset class or strategy or product or as a promise of future performance. Note that these asset class assumptions are passive, and do not consider the impact of active management. All estimates in this document are in US dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on their own judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. If the reader chooses to rely on the information, it is at its own risk. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, or tax advice. The outputs of the assumptions are provided for illustration purposes only and are subject to significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making an investment decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact future returns. Asset allocation/diversification does not guarantee investment returns and does not eliminate the risk of loss.

Index Disclosures: Index returns are for illustrative purposes only and do not represent any actual fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

Riskalyze Disclosure: The Risk Number® is a proprietary scaled index developed by Riskalyze to reflect risk for both advisors and their clients. The Risk Number is at the heart of a sophisticated set of tools to precisely measure the appetite and capacity for risk that each client has, and demonstrate their alignment with the portfolios built for them.

Shaped like a speed limit sign, the Risk Number gives advisors and investors a common language to use when setting expectations, recognizing risk and making portfolio selections. Just like driving faster increases hazards, a higher Risk Number equates with higher levels of risk.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?