by Zac Majors

How Far Should You Take Your Retirement Plan?

A person in their 20s won’t really be focusing on their retirement. Even when they reach their 30s, many people aren’t ready to talk about retirement. However, as people reach their 40s, we have seen many who want to start planning for their retirement.

One of the first questions people ask is how much do we need for retirement? How much should we save? It isn’t until people reach the age of 45 or 50 that a reality starts to hit them; that of mortality. How far ahead should they plan for retirement? 10 years? 20? 30?

How Far to Go With Your Retirement Plan?

There is a dire need to start thinking about creating a lasting legacy. Life expectancy is a crucial part of any retirement planning venture. Of course, no one knows the future. You might have a retirement plan for 20 years, but find yourself in good health even after those long years. This means medical records aren’t really the perfect judge of how far to plan.

However, it’s a good start. It is important to note that life expectancy has been improving over time. In 2021, the average life expectancy for males stands at 76.6 years, while that of women stands at 81.7 years (at birth). This figure has seen a steady rise over the years and is expected to continue rising.

The age of 45-55 is actually the perfect time to get a rough estimate of how many years you have left. A simple medical checkup can actually prove to be an extremely effective way of helping you estimate how many more years you have left.

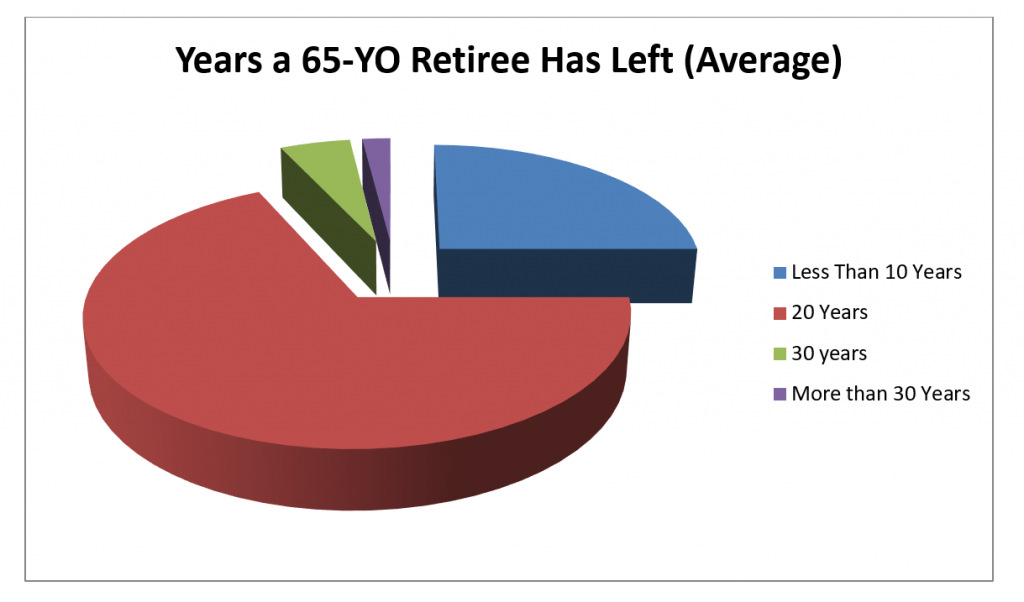

If we look at the averages, a 65-year old retiree will have 20 more years to live (68% chance), with a 5% chance of living 30 more years.

Here is a chart to showcase the same relation. Note that the chart is from 2012 and life expectancy has improved since then. As the chart reads, a 65-year old retiree has a 75% chance of making it 20 years or longer!

Our Advice

In our opinion, individuals should have a reliable source of income that lasts at least until age 90, with a self-replenishing mode of income as well. One prime self-replenishing mode includes Social Security, but that might not always be enough.

If a retiree doesn’t make the 90-year mark, excess savings will be distributed among their children. However, if they do manage to go beyond it, that self-replenishing income will come in handy.

To get a more detailed analysis of your retirement plan and how many years you should plan for, we recommend you discuss options with our retirement planning experts. You can also get in touch with us and we’ll connect you with the right set of people, and answer your question of how far you need to plan for retirement!

Get in Touch

Ready to take control of your finances and enjoy more of what matters in your life?